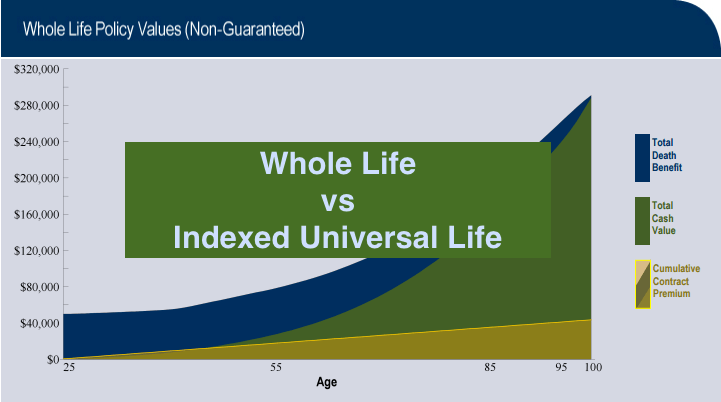

Whole Life vs Indexed Universal Life

When shopping for a life insurance policy, consumers have a large number of choices.From term life insurance that can be purchased for a few dollars per month to whole life insurance that covers you until the day you pass on, there is no shortage of options to consider.

If you are most interested in permanent life insurance, you'll turn your attention to these two options:

- Whole life insurance

- Index universal life insurance (IUL)

Benefits of Whole Life Insurance

The first thing you need to understand is the many benefits that make whole life insurance so popular. Here are four points of consideration:- Guaranteed death benefit as long as you continue to pay your policy premium

- The fixed premium that does not increase as you age

- Option to borrow against the cash value of the policy

- Opportunity to earn dividends, depending on the company you purchase from

Benefits of Index Universal Life

Unlike whole life insurance, a type of coverage that has been in existence for many years, index universal life is a relatively new policy option.Here are some of the reasons why this coverage is attracting a larger number of buyers with each passing day:

- Guaranteed Death Benefit

- Much Lower Costs Than A Whole Life

- Guaranteed Cash Value Growth

- Option To Borrow Money

- Ability To Earn A High Rate Of Return

Now... Don't panic that is only the risk, it doesn't mean it needs to happen. However, that is a normal risk on any Universal Life Insurance.

However, a properly designed policy will stay in force forever.

If you want to get a quick quote, just visit our page here: IUL Quote

Cap, Floor, Participation... Let's Get Technical

So there are many features to an Indexed Universal Life Insurance, and it can be a very hard product to truly understand. If you are considering an IUL you need to find a great agent/broker that truly understands the product.Cap Rate

A maximum rate of return that you can earn on your index.Common caps are 10-14%. Let's say your cap is 12%... This means if the index (let's say S&p 500) does 20% you will be "capped" at 12%.

Check out this fantastic resource for all current Indexed UL Caps.

Floor

The minimum rate of return you will gain. Most of the products offer a 0% floor, which means you will not lose money. There are certain products with higher floors like 1%.Participation Rate

This number determines how much participation you get from the index you picked. So if the S&P 500 did 25% in one year, if you have 100% you get 25%. But if you have %50 you would get 12.5% credited.Common participation rates are 100%, which means you get 100% of the index, after the cap set.

Cost of Insurance

So the real problem with Universal life policies is the cost of insurance. The cost of insurance is how much you need to pay to keep your death benefit and policy active. As you age the cost of insurance goes up along, so the policy's cash value is used to pay for a rising cost of insurance.You have to be very careful if you used an Index UL as retirement and you took out to much money.

Confused yet?

Yes, it can be difficult to truly understand these products. Even though they can be sold on a very simple pitch: No downside risk, with upside potential.The reality is that unless properly designed a policy can significantly underperform in the future. It doesn't mean you can't withdraw money, but you have to be careful.

Biggest Problems With A Whole Life

Very little cash early

Most whole life insurance products Do Not build cash value early. Even though there are many companies that offer products with up to 90% of the premium in year 1 as cash value, most agents are not offering these products because commissions are cut significantly (contact us for a quote at quotes@topwholelife.com).Your vanilla whole life will take years to build any significant cash value to access.

Conservative rates of return

The largest drawback is that the cash value will not illustrate as attractively as an IUL. In reality, whole life is a much more conservative product, but it has guaranteed.Dividends Can Fluctuate

Most top whole life policies are dividend-paying policies. These types of policies have a non-guaranteed dividend that can fluctuate with interest rates and performance of the company offering the policy. So picking a very very strong company has to be one of the most important choices in choosing whole life insurance.Biggest Problems with Index Universal Life

As noted above, buying an index universal life insurance policy could be risky if a policy is not properly designed. Here are some of the many things you need to be aware of:- Your premium could increase over time

- Earnings are based on equity performance (so there is no guarantee)

- It's complicated to understand your policy and how you earn money

Overfund Your IUL

However, a properly overfunded Index Universal Life could be a fantastic product for many different people.What is overfunding?

Overfunding is increasing the premium and cash values without increasing the death benefit. It adds straight cash value which grows very rapidly. Now, most agents will NOT offer this option to you because their commission is cut significantly.

If you have an IUL illustration and you are not sure if it is overfunded, then contact us and we can review the policy for you, and show you how to get more cash.

Inflated Rates Of Return

As we mentioned, Index Universal Life can be a great product, but many agents sell this product incorrectly. The agents show inflated numbers that are not very realistic. Because this became a dangerous practice, the National Association of Insurance Commissioners put a limit on what rate of returns you can illustrate.AG 49 will limit this spread: Index crediting can't be illustrated at more than 100 basis points above the cost of borrowing.

Index Calculator

In addition, even with the limitations of showing large numbers as rates of return, there are still problems. Like getting a 7% rate for every year for the policy (like most illustrations will show) is not only incredibly unlikely, but it can deceive someone to believe an IUL will perform orders of magnitude better than it will actually perform.Check out this toolJTNDZGl2JTIwaWQlM0QlMjJwb2xpY3lnZW5pdXMtcHJpY2UtY2FsY3VsYXRvciUyMiUyMGRhdGEtb2ZmZXItaWQlM0QlMjIxOTAlMjIlMjBkYXRhLWFmZi1pZCUzRCUyMjE3MTElMjIlM0UlM0MlMkZkaXYlM0UlMEElMEElM0NzY3JpcHQlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRnd3dy5wb2xpY3lnZW5pdXMuY29tJTJGcHJpY2UtY2FsY3VsYXRvciUyRmNhbGN1bGF0b3IuanMlMjIlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlM0UlM0MlMkZzY3JpcHQlM0U=

The Final Verdict

You need to consider each and every type of life insurance policy before making a purchase. The debate of Whole Life vs Indexed Universal Life is highly dependent on each individual.This is the only way to be 100 percent confident that you are making the right decision.

In the end, a detailed comparison of whole life insurance and index universal life insurance will help you understand how to best move forward.

Although no two consumers are exactly the same, in our opinion here is the breakdown:

- Whole Life is safe and boring

- IUL is riskier and exiting

However, an overfunded IUL or whole life can be a great product for most insurance portfolios.