Does An Overfunded Whole Life Policy Make Sense For You?

Cash-value life insurance has been around for decades.

If you are reading this article, you are likely looking for the Best Whole Life Insurance Policy. Or you are in the middle of your research, looking for more details on Cash Value Life Insurance.

This article will help you decide if Overfunded Life Insurance is for you?

Also, we will list alternative strategies that may fit your plan much better than an overfunded policy.

Quick Overview Of Overfunded Cash Value Life Insurance Policies

Overfunded Cash Value Life Insurance maximizes cash value and minimizes death benefits. The idea is that they build cash value quickly that you can access for any reason. Also, this cash value grows predictably and safely.

Overfunded policies are most noteworthy in the press from books and authors like Nelson Nash’s – Infinite Banking and Pamela Yellen – Bank On Yourself.

Both authors offer great information about whole life insurance and how to use it.

But is overfunded life insurance the right purchase for you?

Here is an excellent video from Bank On Yourself that explains their concept

Video Reference: https://www.bankonyourself.com/

Best Overfunded Life Insurance

See How To Maximize Your Cash Value

Why Are You Looking Into An Overfunded Whole Life Insurance Policy?

There are many things to consider before you purchase an overfunded policy. However, an essential aspect is WHY?

To make sure a policy makes sense, you should ask yourself these questions:

-

Why have you decided on whole life?

-

What do you plan to use the policy for?

-

How do you plan do fund your policy?

-

When do plan to access the cash value?

-

Can you fund your policy even if you were to have a bad income year?

-

Why do you believe that an overfunded policy is the best plan?

-

Do you have a need for life insurance?

Any competent agent should ask you all of these questions to design your policy correctly. The answers are critical to making sure you are not buying something that doesn’t make sense.

When Do You Plan To Use Your Cash Value?

WHEN you plan to access, your cash value can greatly dictate if an overfunded policy is the best fit.

All buyers of life insurance will fall into four categories:

-

Do not plan to access cash value.

-

Want to access cash value for retirement.

-

Would like to access cash value in the next 10 years.

-

Are looking to access cash values ASAP.

Now we will use these to determine what you should be considering.

1. Do Not Plan To Access Cash Value

If you do not plan to access your cash value, we would not recommend overfunded life insurance.

Overfunded life insurance offers many benefits, such as guaranteed death and level premiums.

Otherwise, you will be “overpaying” for the living benefit (Cash Value), and your death benefit would be smaller than it should.

So if you did not access cash value, we would suggest looking into a Universal Life Policy. Universal Life policies come in many shapes and sizes, but you should look into Guaranteed Universal Life Policies in particular.

This policy is like permanent term insurance.

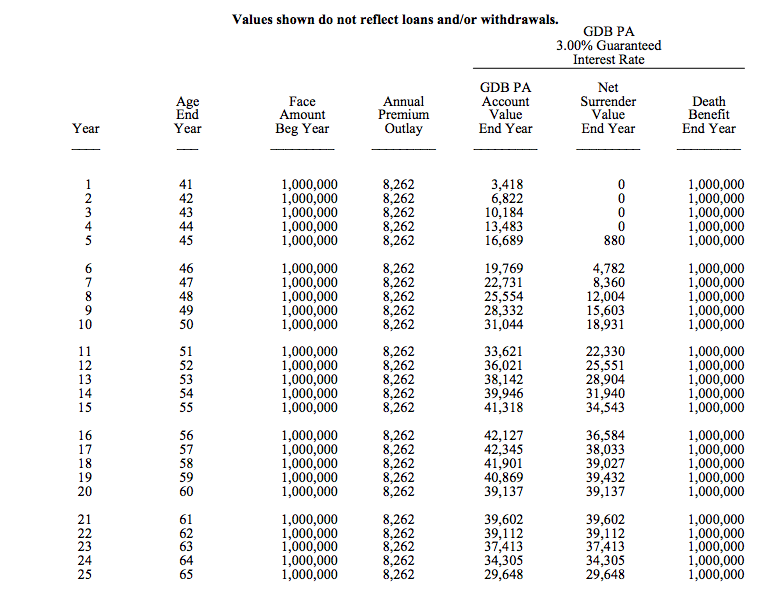

Universal Life Policy

Male Age 40, Good Health

Death Benefit: $1,000 per month

Female Age 40, Good Health

Death Benefit: $1,000,000

Recap

You can see in the above two illustration examples cash value is not focus.

For the male’s policy:

- In year one, the surrender value is $0.

- By year five, the surrender value is $880.

- At age 65 surrender value is $29,640.

- At age 65 death the benefit is $1,000,000

For the female’s policy:

- In year one, the surrender value is $0.

- By year five, the surrender value is $5,461.

- At age 65 surrender value is $67,352.

- At age 65 death the benefit is $1,000,000

The surrender values do accumulate, and Universal Life Policies have a cash value; however, the primary reason for this cash value is to help keep premiums level into the later years. As the cost of insurance, ” mortality cost,” rises over time, the price will also increase. The rise in costs for mortality all happens in the background, and you will not see an actual change in premium as the policy owner.

Term Life Insurance Instead

You will often be better off buying a term life policy if you do not want cash value. Term life policies offer you cheap coverage for a certain period.

Typically that time frame is:

- 10 Years

- 20 Years

- 30 Years

But some policies and companies offer term life policies with more extended time frames. Term life policies do not have a cash value that you can access.

So if you don’t care about cash value, consider a term life policy. And you can get a quick-term quote next:

2. I Would Like To Access My Cash Value For Retirement

If this is you, we might recommend considering the purchase of overfunded life insurance.

However, if you do not need the cash value in the early years of your policy, a traditional whole life policy could be excellent.

If you are between the ages of 50 – 60, you would be better off with a limited pay style policy.

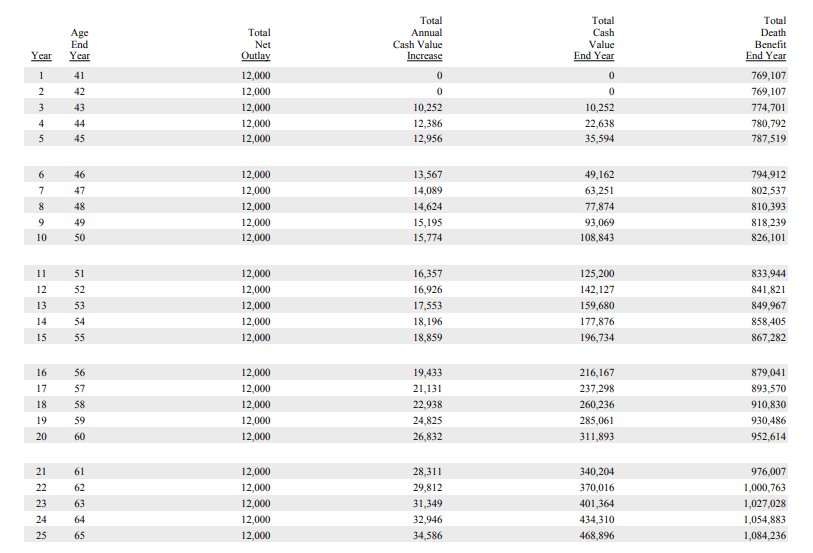

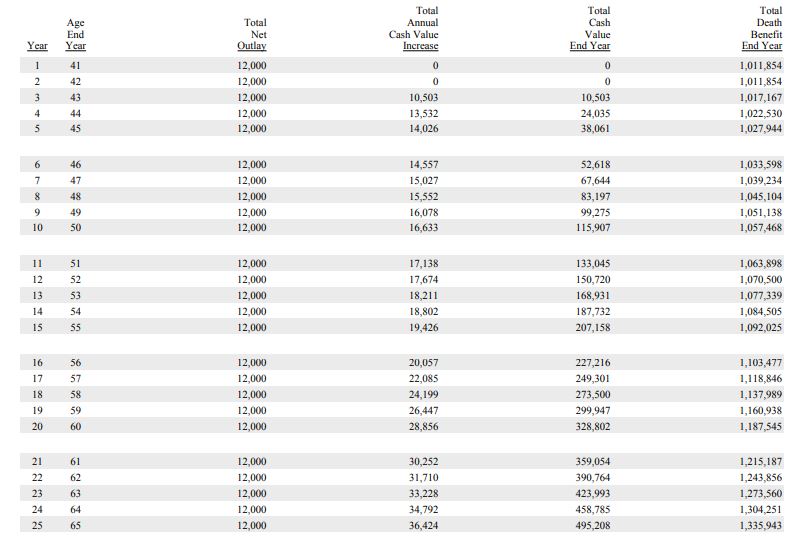

Traditional Design

The example below illustrates a design that offers substantial cash value and death benefit by age 65.

Traditional Whole Life Policy

Male Age 40, Good Health

Premium: $1,000 per month

Female Age 40, Good Health

Premium: $1,000 per month

Recap

You can see in the above two illustration examples do accumulate cash value in the later years.

For the male’s policy:

- In year one, the cash value is $0.

- By year five, the cash value is $35,594.

- At age 65, he will have $468,202.

- At age 65 death the benefit is $1,084,236

For the female’s policy:

- In year one, the cash value is $0

- By year by, the cash value is $38,061

- At age 65, she will have $495,208 in cash value.

- At age 65 death the benefit is $1,3304,943

The cash values accumulate much more efficiently than Universal Life Policies. However, you will also note the premiums are a bit higher for these policies.

The cash value growth for these policies are much stronger in the later years. In the early years the cash value is lower as much of your premium is going to pay for the mortality expenses that the policy caries.

Best Overfunded Cash Value Life Insurance

See How To Maximize Your Cash Value

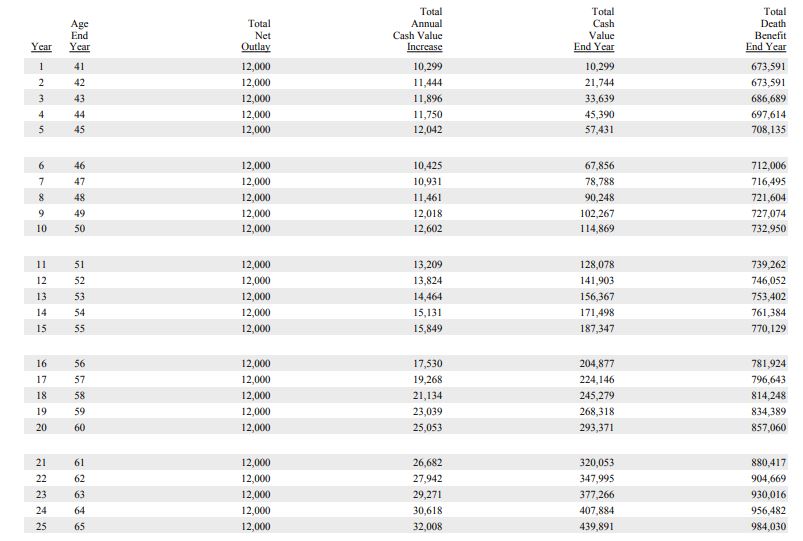

3. I Would Like To Access My Cash Value In The Next 10 Years

If this is you, I would recommend overfunded life insurance.

This policy design will have a lower death benefit and substantially more cash value in year one.

You can see this by comparing the traditional and overfunded example.

Always confirm the policy is not a Modified Endowment Contract (MEC).

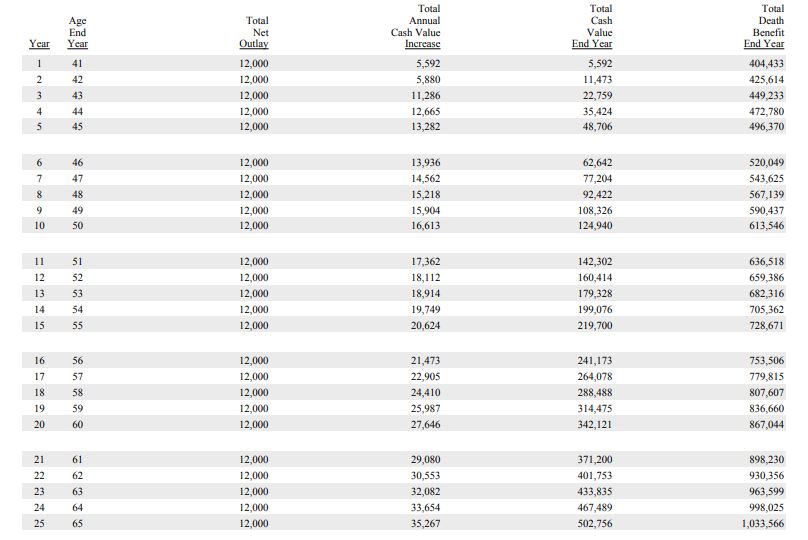

Overfunded Cash Value Life Insurance

Male Age 40, Good Health

Premium: $1,000 per month

Female Age 40, Good Health

Premium: $1,000 per month

Recap

You can see in the above two illustration examples accumulate strong early cash value.

For the male’s policy:

- In year one, the cash value is $5,592.

- By year five, the cash value is $48,706.

- At age 65, he will have $502,756 in cash value.

- At age 65 death the benefit is $1,033,566

For the female’s policy:

- In year one, the cash value is $5,839

- By year by, the cash value is $50,998

- At age 65, she will have $527,091 in cash value.

- At age 65 death the benefit is $1,240,313

These two policies are very efficient and have high early cash values. The above policies are 50% blended. 50% blend means that half of the total $12,000 premium will pay for the base contract, and the other half is going towards cash value.

Hence why you see so much more cash value in the first year. The difference you will note is that the death benefits of these policies are much lower than the “traditional whole life policies.” Depending on how much life insurance you need will impact what type of design would suit you.

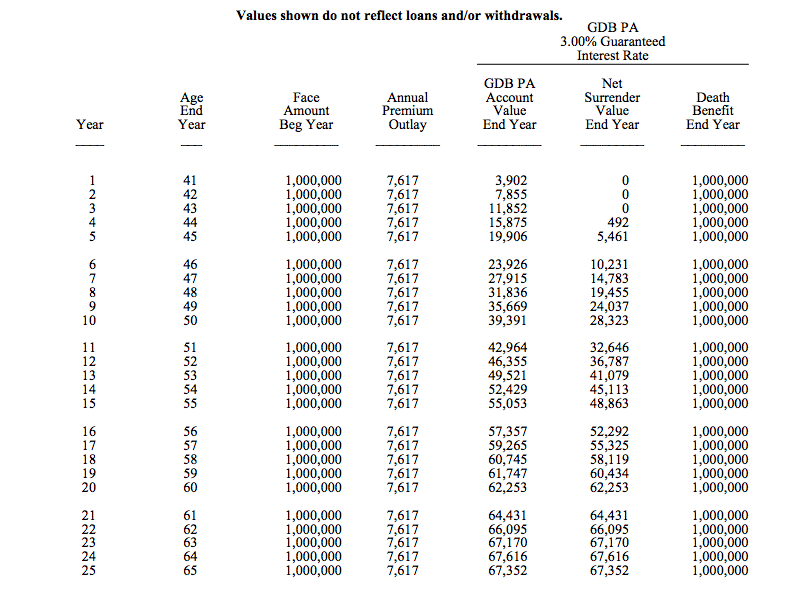

4. I Would Like To Access My Cash Values ASAP

When you look to access cash value very quickly, I would recommend an overfunded life insurance.

I believe that this policy by MassMutual provides the strongest year on the cash value in the market.

This policy is called the Legacy High Early Cash Value or HECV.

See the review on MassMutual’s HECV.

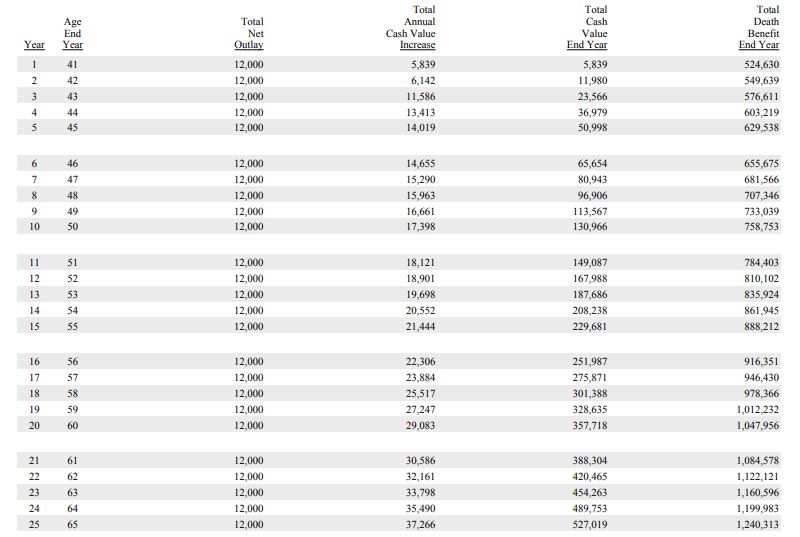

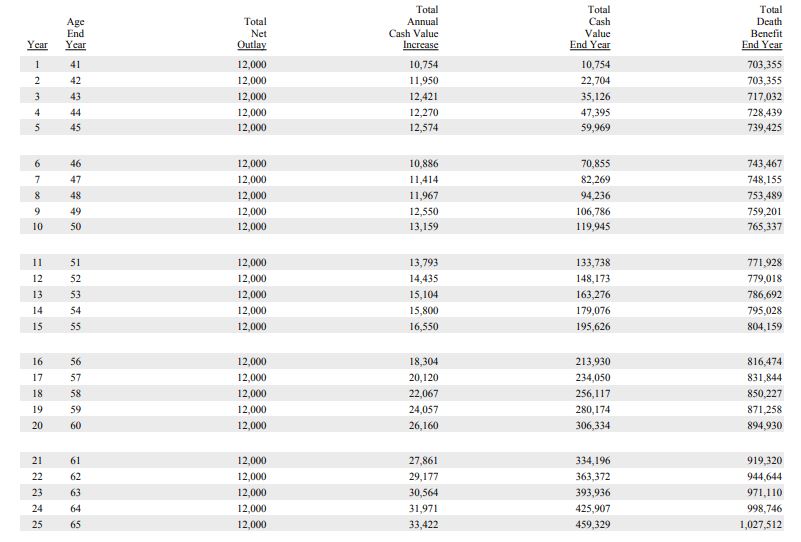

High Early Cash Value Whole Life Policy

Male Age 40, Good Health

Premium: $1,000 per month

Female Age 40, Good Health

Premium: $1,000 per month

You can see in the above two illustration examples accumulate strong early cash value.

For the male’s policy:

- In year one, the cash value is $10,299.

- By year five, the cash value is $57,431.

- At age 65, he will have $439,891 in cash value.

- At age 65 death the benefit is $984,030

For the female’s policy:

- In year one, the cash value is $10,754

- By year five, the cash value is $59,969

- At age 65, she will have $459,329 in cash value.

- At age 65 death the benefit is $1,027,512

As you can see, these two policies are the most efficient for cash value in the first five years. In addition, the above policies have significantly more cash value and death benefits than the other two options.

However, these policies do not offer the most substantial long-term growth. By age 65, these policies underperform the traditional and overfunded policy in cash value and death benefit. If you are looking to leverage cash value in the first five years of your plan, this is the best choice.

The HECV policy is also a great option for business owners who need life insurance and hate “losing’ their premiums. If you set up a HECV policy, you can essentially recoup your premium contributions in the form of the cash value in 5 years. That’s not a bad deal!

Benefits Beyond Cash Value

Benefits Beyond Cash Value

An overfunded policy requires a higher premium, but it gives you tremendous cash value growth. But you get a lot more than cash value growth:

Death Benefit

Overfunded Live Insurance not only offers great cash value but also offers a tax-free death benefit to the beneficiaries of your policy.

Tax Benefit

Overfunded Life Insurance is a tax-advantaged product. The cash value grows tax-deferred, and the cash value is accessible tax-free!

Growth

Depending on what company you work with, the tax-deferred growth can be between (4-6%) annually. So over time, your cash value will grow faster and faster.

What does your savings account pay?

Exchange

As a policy owner, you can move your cash from one life insurance policy to the next without income tax liability. You can even move your cash value into an annuity as well.

Market Protection

Markets go up and down. When markets go, DOWN overfunded life insurance provides protection. The policy is not correlated directly to the stock markets. If the market declines, the cash values are vested and will not go backward.

No Age Restrictions

Cash Value life insurance has no liquidity restrictions. Your cash can be taken out of the policy before age 59 ½ for any reason without government-imposed penalties, unlike IRAs and 401ks.

Well, that pretty cool!

Privacy

In reality, overfunded life insurances are private. This means that there are no transaction histories when you access to cash in your policy; it does not appear on a credit check.

Tip: Most schools do not look at cash values accounts during financial aid applications. Overfunded life insurance is a great place to save for kids’ college.

No Limits

Overfunded life insurance has no contribution limits. There are NO caps on the amount you can contribute.

The only limitation is if you can qualify for enough death benefit to allow a large cash contribution into the policy without making the policy a Modified Endowment Contract.

The Bottom Line

In conclusion, talk to an experienced agent!

You will want to consider very carefully who is the person helping you design an overfunded policy.

Suppose the agent is not asking you questions like the ones listed at the beginning of the article. I can assure you they are not well versed in designing a policy to fit your needs.

Final Thoughts

Finally, overfunding life insurance is not appropriate for every person.

It is a valuable option for investors in good health who are serious about long-term savings and want tax-efficient vehicles. However, if you plan to buy an overfunded life insurance policy, the policy must be carefully designed.

It is important to work with an independent and licensed life insurance professional. The agent must have experience with overfunded life insurance or you will get a policy that may not fit your objectives.

I like this summary! Only want to let you know that you have a numeric type-o under the Guaranteed UL results.

For the male’s policy:

In year 1 the surrender value is $0.

By year 5 the surrender value is $880.

At age 65 surrender value is $29,640.

At age 65 death the benefit is $1,00,000 <——- ???

For the female’s policy:

In year 1 the surrender value is $0.

By year 5 the surrender value is $5,461.

At age 65 surrender value is $67,352.

At age 65 death the benefit is $1,00,000 <——- ???

Thanks Rob for the input we updated it.