Is whole life a good investment? In this article you will find everything about whole life insurance, and we will compare whole life insurance with different strategies.

People like Dave Ramsey and Suze Orman have made Whole Life Insurance into this evil product. They will say never to get a whole life insurance policy.

However, the reality is very different, and we will explore some of the reasons why people say whole life insurance sucks.

We will help you determine: Is Whole Life A Good Investment?

The 7 Lies About Whole Life:

-

- Whole Life Insurance has low rates of return

- Term Insurance is better than whole life insurance

- Buy Term and Invest the Difference vs. Whole Life Insurance

- Whole Life Insurance pays high commissions

- The cash value in a Whole Life takes a long time to really grow

- I will not need insurance when I am older so term insurance is better

- If I die I only get the death benefit with Whole Life

Before we get into the details, let’s start with the basics:

There are multiple kinds of life insurance to use to protect your income.

Two of the most common ones are Term and Whole Life Insurance.

Types of Life Insurance: A quick review

- Term Insurance: You pay low premiums to get a high death benefit for a specific period called a term. The most common terms are 10, 20, and 30 years. During the term, the cost of insurance remains the same. After the term expires, the policy either disappears or starts going up in price. The most common use for term insurance is to protect your income when you have dependents.

- Whole Life Insurance is a type of permanent insurance where you pay higher premiums for a lower death benefit, but the coverage doesn’t expire. Most basic whole life insurance are paid for 100 years, but there are other policies you only pay for 10, 20 years, or until age 65, but the coverage remains even after the premium is paid. Whole Life builds cash value that can be accessed at any point in time. The most common uses of whole life are for wealth transfer, cash value accumulation, and estate planning.

- Universal Life Insurance is a type of blend between term and whole life policies. It can be either permanent or temporary. It can build cash value, but it needs to be designed properly because of the rising cost of insurance. However, Universal Life Insurance it’s outside of the scope of this article. For more info check out: Universal Life vs Whole Life

Let’s go over some of the misconceptions about whole life insurance.

1 – Whole Life Insurance Has Low Rates Of Return

Let’s talk about rates of return. In reality, before we get into all the negatives and positives about whole life, we first need to have a class about average rates of return vs. real rates of return (geometric rates of return). If we don’t understand these rules, we can not have a level playing field when we compare whole life insurance to other products. I see people quoting average rates of return all the time as if they were real rates of return.

Assumption: We invest $1,000 into the market with advisor Mr. Awesome from the Awesome Group.

- Year 1: The market does excellent! And We make 50%. Mr. Awesome tells me that… yea he is incredible.. and that we made lots of money, and we should be happy.

- Year 2: The market takes a hit! And we lose 50%. Mr. Awesome calls me and tells me not to worry because we have averaged 0% over this crazy period.

My question to you is how much money do we have in this scenario??

Take some time to think about it. The intuitive answer is $1,000. Excellent told us we averaged 0% (+50%-50%/2=0%). His math is right, so we must have $1,000.

But money is not math, and math is not money. You look at your statement, and you see that you have $750. Start with $1,000, up 50% that gets us $1,500, and down 50% that takes us to $750. The real (geometric) rate of return is -13.397%.

Now that we understand average rates let’s look at real rates of return in the market. First, I want you to realize that what you see in your investment paper statements is the average rate of return, not the real rate of return.

The market (the dow jones industrial average) has had a 7.1% average rate of return, and a real rate of return of approximately 5%. Does it make sense to take all that risk to get a 5% rate of return?

Also, the average investor will underperform because of human psychology. Buy high and sell low. This has been proven through multiple studies. The average investor in the U.S. earns a little more than 2% per year. That is very sad.

A good Whole Life Insurance will get you a 4-5% rate of return after fees and taxes in the long run!

2- Term Insurance Is Better Than Whole Life

We have heard that hundreds of times by most celebrity “advisors.” If you google whole life insurance, you are bound to find many articles regarding whole life vs. term insurance. Most of them saying that term insurance is the clear winner.

How is it that there are so many financial advisors vilifying whole life and saying that term is always better?

It’s incredible to think that two products intended for two different purposes are compared as if they were the same product. In reality, they serve two very different needs.

It’s like comparing bonds vs. stocks and saying that stocks are always better. The reality is that most people should have both types of policies. The term gives you great coverage for an affordable price, but it expires.

Whole Life Insurance gives you permanent life insurance and cash value that you can access that free, but there is more out of pocket cost at the beginning.

So is whole life a good investment?

One of the main reasons that people always favor term insurance; it’s because of this concept: Buy term and invest the difference. The idea says that instead of paying for whole life insurance, one can pay for term insurance and invest the difference into some aggressive investment and outperform the whole life.

3- Buy Term and Invest The Difference VS. Whole Life Insurance

For us to compare these two methods and decided is whole life the best investment we have to look at the numbers more in-depth.

Let me use the company that made buy term and invest the difference famous for running some numbers, Primerica.

Let’s compare whole life insurance and term insurance.

The insured with a budget of $2,600 per year: 30-year-old male, in good health and needs $500,000 of insurance.

- A 30 yr Term Insurance would cost approximately $600/yr. That would leave us to invest $2,000/yr. We have to remember these investments aren’t free; you have to pay for them. Typically, you will get invested into A-share mutual funds and pay a sale charge of approximately 5.5% upfront. That means you have left $1,890 to invest each year. Also, there is a charge for just keeping mutual funds every year (of about 1.25% to be conservative). Assuming you could get a rate of return of 7% (which we know from our rate of return conversation is very very unlikely). At age 65, you have $225,357 and NO death benefit.

- Let’s run some whole life insurance quotes online in topwholelife.com, and see what you will have at age 65: Cash of $214,317 and a Death Benefit of $500,000.

Which insurance strategy would you pick?

One strategy, we have to HOPE that we do well, ride the market volatility without ever making a mistake, and HOPE we don’t need life insurance. If you see, I used a tremendous geometric rate of return so don’t get me started because I could use even lower rates of return, because no one will put 100% of their investments into the market (Bonds? anyone).

But wait you always hear whole life insurance is evil, how is this possible? It’s because people don’t look at the numbers correctly. So they don’t know if whole life a good investment?

By the way, I am not suggesting whole life is the best product always, but I don’t hear anyone saying bonds suck because stocks beat them! So please, buy term and invest the difference is not the answer to everything.

Now we are going under the covers of life insurance. Yes, people make money recommending these products, so let’s look at the numbers.

4- Whole Life Insurance Pays High Commissions

Yes, whole life insurance does pay higher commissions than term insurance, but that is just an obvious statement. That is like saying that selling a house that costs $900,000 vs. a $150,000 is wrong because the real estate agent makes more money on the higher sale…

Don’t get me wrong, some agents will recommend whole life at the wrong time, but unfortunately, that is the agent’s fault, no the product’s.

Most of the time, both term insurance and whole life insurance will pay the same percentage in commission, but one number having a more substantial investment would mean a higher commission.

I am a considerable term insurance proponent, but saying that something is worse because of commission is not a great argument.

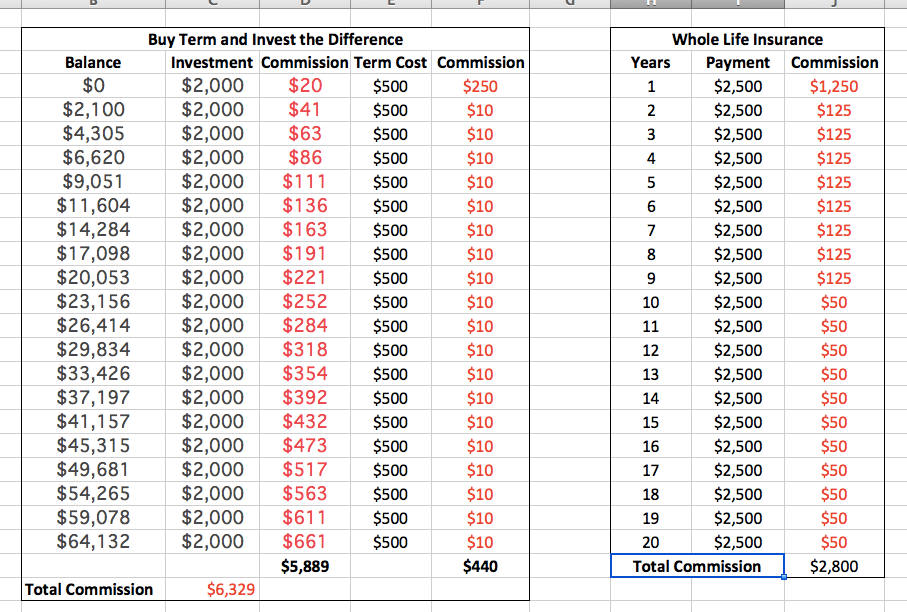

If we compare whole life insurance and term insurance, we need to examine the entire plan, which means compare buying term AND invest the difference vs. whole life. Don’t worry; we ran all the numbers for you.

We ran the numbers for a 30-year-old healthy male:

- Run a term insurance quote online $500,000 for $500/year and invest $2,000/yr.

- Paying 1% of total fees in your investments.

- Assuming a 6% geometric rate of return (if you think this is low, please see the Rates of Return above).

- Let’s run some whole life insurance quotes for $500,000 for $2,500/yr.

The results may surprise you:

- Buy Term and Invest the difference commissions after 20 years: $6,329.

- Whole Life Insurance commissions after 20 years: $2,800

The result may be surprising, but the effect of compounding interest also happens in commissions. In Buy Term and Invest the difference you have 20 years of compounding of commissions, as opposed to a flat amount in the whole life. If you look at the numbers after 30 years, the gap is even more extensive.

Now, as stated before, some agents will oversell a whole life policy to get a higher upfront commission, but understand that in the long run, the commissions on the whole life insurance will be much lower than in buy term and invest the difference.

Is whole life an excellent investment because of this alone, no.

Related: Lowest commissioned whole life – MassMutual’s HECV Policy: High Early Cash Value

5- The Cash Value In A Whole Life Takes A Long Time To Really Grow

First of all, YES, your cash value does take a long time to grow. However, we always have to compare against a different product to put things in perspective. Many advisors will suggest you max out your 401k always. I find this indignation with the cash value at the beginning hilarious for two reasons:

- 401k’s and market investments can go down in value! But in this scenario, the experts will tell you not to worry because you still have time before you need to access the 401k.

- 401k’s cannot be accessed without penalties (excluding loans) until 59 1/2. So what does it matter what your value is at the beginning?

So do we care about money performance at the beginning of the end?

Your AVERAGE whole life insurance cash value in the first few years will be close to zero. That is not very exciting, so if you do a whole life for 2 years and stop, it will be the worst investment you ever made. But if you intend to stick with it for longer, you can reap great benefits.

Not all whole life insurance policies are made the same; policies can be designed where you have much cash value at the beginning of the plan.

There is a way of creating high cash value even in the first year. Most banks own billions of dollars in life insurance (Bank Owned Life Insurance), Banks in America have more than $29 billion in BOLI (Source)

Do you think they would invest in life insurance if it weren’t a good investment?

Is whole life a good investment for this reason only?

No, but if the banks and corporations leverage this, why not you?

The reason they invest in life insurance is that their investment time frame and our are investment time frame are very different. A Bank doesn’t care about what their money is doing today; they lend a mortgage for 30 years; they care what their money does in the long run. The banks know that the cash value of a life insurance policy is a safe investment with a high rate of return.

Related – Top Benefits of Becoming Your Own Banker

6- I will not need insurance when I am older, so term insurance is better

I keep seeing this statement everywhere, and in all reality, it’s not true. Most people will need to have life insurance throughout their lives. Yes, the need for life insurance is more significant when there are dependents involved (like kids), but even after the kids are gone, couples will need each other’s income to protect themselves. They will need each other’s social security; they will need each other’s pension (if they are lucky to have one), they will need each other’s annuity income, etc.

The concept of not needing life insurance comes from the idea that you will have so much money saved in the future that you can self-insure.

The fact is that most older people do need to self-insure, but that’s because the cost of life insurance is prohibitive at some point, or they are unhealthy. But the need is still there because the average American doesn’t have enough in savings to self-insure.

Related – Do I Need Term or Whole Life Insurance?

7- If I die I only get the death benefit with Whole Life

This is true for individual whole life insurance companies where the death benefit doesn’t grow each year. Be careful of these older policies, as there are better products out there, so when you run whole life insurance quotes, make sure your death benefit is growing.

However, most top whole life insurance policies have a death benefit that grows every year.

Not only is your cash growing each year, so is your death benefit; if you die, your family will get a higher death benefit than when you started the policy.

In Media, All Whole Life Policies Are The Same

We see in the media how all whole life insurance is treated as one product. The truth is that there are multiple different kinds of whole life, from the very good, to the very bad. It might be hard to compare whole life insurance companies, so to help you understand the difference, here are a few key elements:

Mutual Company vs. Stock Company

The type of company you pick for whole life insurance makes a huge difference. The main difference between stock and mutual company is who receives part of the profits from the company.

Stock companies have stockholders that own the company, and as such, the company has to respond to them. The main incentive for the company is to increase performance for the stockholders, through stock buys backs or dividends.

Mutual Companies do not have stockholders; they have policyholders. Just by owning a policy with a Mutual Company, you become part-owner of the company. As a policyholder, you are entitled to a dividend that will help your plan grow.

This dividend will make quotes from Mutual Companies beat Stock Companies most of the time. Don’t be fooled; some companies will claim they are mutual, but their whole life policies do not participate in the profits of the company.

These are the largest top Mutual Companies out there:

- MassMutual

- Northwestern Mutual

- New York Life

- Penn Mutual

- Guardian Life

Other factors will affect performance in all whole life insurance from company to company:

Direct Recognition vs. Non-Direct Recognition

This is a very technical concept, we ran the numbers and what we found was that on average non-direct recognition companies would perform better than direct recognition, but that is on average. Don’t be fooled; there isn’t a huge difference between direct and non-Direct recognition.

Other factors have a much higher impact on the policies, like the current dividend, guaranteed rate, loan rate, etc.

Here is a list of the top Non-Direct Recognition companies:

- MassMutual

- Ohio National

- New York Life

Distributions from a Whole Life Insurance

One of the best tips we can give you is that if you want to use your cash value in the future, do not compare whole life companies only on their cash value. Compare whole life quotes based on how much money you can withdraw from your policy.

Even if the cash value is the same in two companies, there can be a difference of 80% in how much cash you can pull from one company to the next, even when the cash values are the same! What you need to see are illustrations with distributions from the cash value.

Whole Life Insurance can be a great tool if used properly to generate income in the future.

Related – Whole Life Insurance For Dummies

Enough with the negatives, you see in the media. Now let’s look at the positives of Whole Life Insurance:

- Permanent Death Benefit

- Whole Life Insurance guaranteed cash value

- Market Diversification in Whole Life

- Cash value on Whole Life Insurance only goes Up

- Whole Life Cash Value Tax-Free

- Flexibility in Premium Payments in Whole Life Insurance

1. Permanent Death Benefit In Whole Life Insurance

With Whole Life Insurance, your life insurance will be in force the day you die. This seems very obvious, but you have no idea how many horror stories exist about people that didn’t have permanent insurance, and they became uninsurable. Even worse people that died right after their term expired. If you have had a story, I encourage you to share it in the comments section.

The only insurance that matters is the one that is in-force the day you die. Beneficiaries will not ask when they receive a death benefit check, what kind of policy it was. It doesn’t matter if it’s a term, whole life, or universal life.

2. Whole Life Insurance Guaranteed Cash Value

Whole Life has guarantees on the cash value. That means that no matter what happens with the policy, there is a rate of return that the company will pay, guaranteed. Nowadays, the guarantees for top whole life companies are between 3-4%.

These numbers are in the long run as the policy endows because, at the beginning of the policy, the cash value doesn’t grow. However, compare that to most investments that do not have any guarantees.

3. Market Diversification In Whole Life

Every number that challenges whole life uses 100% market exposure to compare performance. That is silly. We know that diversification and asset allocation are incredibly important. I don’t hear advisors write articles about how stocks are always better than bonds.

Every advisor will say you need to have a proper balance between aggressive investments and conservative investments. Whole Life Insurance is part of the conservative side.

4. Cash Value On Whole Life Insurance Only Goes Up

This concept will not be valued by people that tend to favor market exposure, but the fact that your cash value only goes up in price can give great peace of mind, and flexibility. As your other investments go down with the market, you can rest assured that your whole life cash value will only go up each year.

This will cause people to make fewer rash decisions with the rest of their investments, and hopefully not fall into the buy high sell low mentality.

5. Whole Life Cash Value Tax-Free

One of the main reasons that people use whole life insurance is because the cash value could be accessed tax-free. Also, you can access the cash at any point in time.

For high-income earners that do not qualify for a ROTH IRA, life insurance is one of the few strategies where they can grow money tax-deferred and access cash tax-free. Did you know that Disney used a loan out of his life insurance policy to pay for Disneyland?

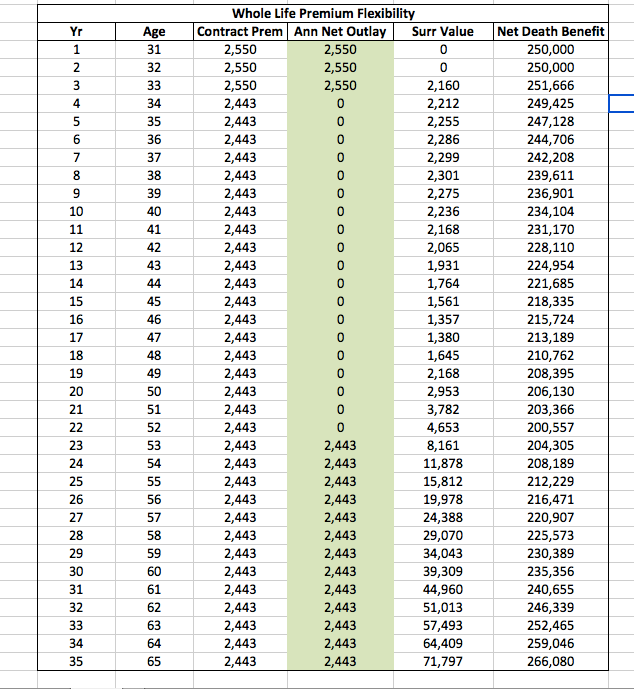

6. Flexibility In Premium Payments In Whole Life Insurance

If you can’t make a payment, you can utilize the cash value to make payments for the whole life. We have run some whole life’s that after paying 3 years, you could stop payments for 20 years+, and the policies would still be in force.

I know that seems crazy, but without using names, one of the top whole life insurance companies out there gave us the following results:

A 30-year-old healthy male has whole life insurance for $250,000, he pays the premiums for 3 years, and then he stops paying for 20 years. Then he starts paying again, and the policy keeps on going! That is some incredible flexibility.

Now let me make it clear, I am not suggesting you do this, but I do want to illustrate how flexible whole life insurance can be.

Tip 1: Whole Life Insurance Can Be Blended With Term Insurance

To create the best results for cash value and still get the coverage you need, you can blend a whole life policy with term insurance to increase the death benefit. This blend gives you the best of both worlds. You can have term insurance and still get some of the other benefits of whole life insurance.

Tip 2: Whole Life Cash Value Increase

There are ways to deposit more cash value into your whole life that will turbocharge your policy and make it perform even better. These deposits called paid-up additions. It is a fancy term, but know that if you want more cash that can be achieved easily.

You can deposit one lump sum of money or period deposits that will go straight into the cash value of the policy.

Tip 3: Instant Quotes And Compare Whole Life Insurance

Now you see that many tools and companies help you quote term life insurance online:

- PolicyGenius

- SelectQuote

- Term4Sale

Is there a similar tool to get whole life insurance quotes online?

Yes, you can get instant whole life insurance quotes, and compare whole life insurance companies in a matter of seconds at Top Whole Life

Check out life quotes to see if whole life is the best investment for you?

Whole Life Can Be A Great Alternative

As you can see, there is a place for whole life insurance in your portfolio. Is whole life a good investment? It is up to you to decide…

Don’t let people and media scare you into these absolute statements where one thing is always better.

The truth is every product has a purpose, and as long as it’s being used correctly, it will fit your situation. Compare whole life insurance with other strategies and products; you can see that it can be a great alternative.

Also, not all whole life insurance are made the same. We created a tool to run instant whole life insurance quotes online and compare whole life insurance companies.

We only utilize the best companies with the best products. It will take you 1 minute to see your numbers: topwholelife.com

Please leave us a comment!

![7 Lies About Whole Life Insurance [Is Whole Life A Good Investment]](https://topwholelife.com/wp-content/uploads/2015/09/compare-whole-life-insurance-header.jpeg)

You are better off hokoing up with a General Agency. They allow you to use their software to shop out all the carriers they are contracted with. You will have to contract with the agency and then use them for all application submissions.References :

Neela, no general agency will give a client free access to a quoting tool that they can play around with. That is the value we are providing.

I think you’re doing a misstatement when you said: “Let’s run some whole life insurance quotes online in topwholelife.com, and see what you will have at age 65: Cash of $214,317 and a Death Benefit of $500,000.” Because at age 65 the insured (owner) has yes both the $Cash of $214,317 and the Death Benefit of $500,000 but what you don’t say is, neither the money (cash value) or the death benefit will be on the hand of the the insured or the beneficiary. The whole life insurance will pay either or that. If the insured die, the beneficiary will get only the death benefit, not the cash value. If the insured doesn’t die at the age 100 (yes, that’s when the policy expire, not at age 65) then the insured will get the death benefit not the cash value or whichever is greater, and the insurance company will keep the other one.